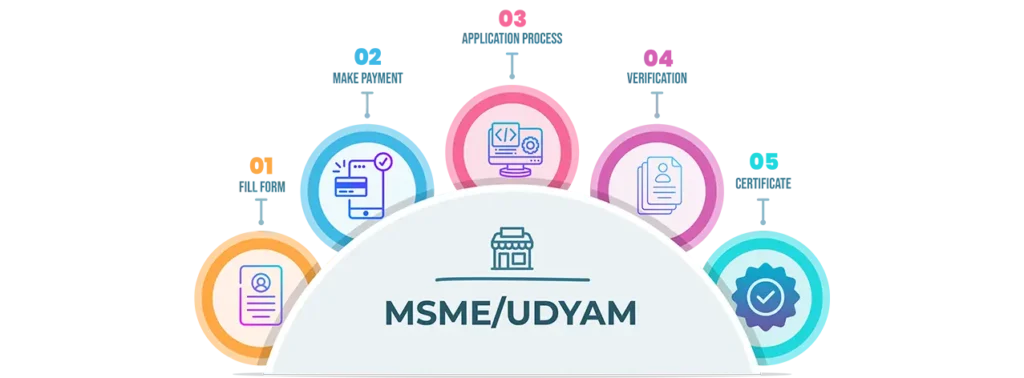

Udyam Registration or MSME Registration is the new process for registering MSME (micro, small and medium enterprises) launched by the Ministry of Micro, Small & Medium Enterprises on July 1, 2020. The Ministry had also revised the definition of MSMEs from the same date.

An enterprise for this process is known as Udyam, and its Registration Process is known as Udyam Registration. A permanent registration number along with a recognition certificate will be issued after Registration.

Easy, Fast and Reliable

What Are Benefits Of UDYAM?

Udyam registration is a mandatory certification for micro, small, and medium enterprises (MSMEs) in India. It provides various benefits and facilities offered by the government and improves the credibility of the business.

Government Benefits

MSMEs with Udyam registration are eligible to avail of various subsidies, loans, and tax exemptions offered by the government.

Easy Loan Access

Udyam registered MSMEs can access loans from banks and financial institutions at favourable terms and interest rates.

Tender Eligibility

MSMEs can participate in government tenders, providing new business opportunities.

Improved Credibility

The Udyam certificate serves as proof of MSME status and enhances the credibility of the business, making it easier to do business with larger firms and government agencies.

Documents Required For Udyam Registration

The Online Udyam Registration application process is based on self-declaration, and there is no further requirement to upload any documents. The applicant will only need to furnish their 12-digit Aadhaar Number, PAN, and Bank Account details of Business for the registration process:

- PAN card of Owner/Partner

- PAN card of the registered business

- Identification/Aadhar card of owners

- Passport size photos

- Bank account details (cancelled cheque or passbook)

- Address proof of the registered office

The GST levied by the central government on goods and services is Central GST (CGST), and that by the states is State GST (SGST). However, on the supply of goods and services outside a state, Integrated GST (IGST) is collected by the centre. IGST applies to imports too.

MICRO ENTERPRISES

- Investment in plant, machinery, or equipment does not exceed Rs. 1 crore.

- Annual turnover does not exceed Rs. 5 crores.

SMALL ENTERPRISES

- Investment in plant and machinery or equipment does not exceed Rs. 10 crores.

- Annual turnover does not exceed Rs. 50 crore.

MEDIUM ENTERPRISES

- Investment in plant and machinery or equipment does not exceed Rs. 50 crore.

- Annual turnover does not exceed Rs. 250 crores.

What Users Saying

Our team offers a wide range of products and services to small and medium business enterprises.