FSSAI ANNUAL RETURN

Do You interested in FSSAI Annual Return Filing? indiabuzsolution provide you with the best services .

- Expert assistance

- Complete online Process

- End To End Compliances solutions

- Track Application Status

3 Reasons Why Customers Love Us

Professionalism

Much, much more affordable than other professionals

All in One

Leave legal, tax and compliance to us

We Deliver

1200+ authentic reviews, industry leading average of 4.4/5

Overview of Fssai Annual Return

The FSSAI was established under the Food Safety and Standard Act, 2006, which is related to food safety and its regulation in India. The FSSAI (Food Safety and Standard Authority of India) is responsible for protecting and promoting public health by regulating the food industry and framing laws, rules, and regulations related to food and its sale, manufacturing, distribution, storage, and import within the country.

The term food safety denotes that the food is healthy, clean, and free from diseases like poisoning and ache, etc. Thus the FSSAI ensures that the food consumed by beings is safe and healthy by providing Food Licenses to the Food Business Operators (FBO) and that license is known as FSSAI License .

But, only possessing a License is not sufficient, it is equally important to file the FSSAI Annual Return and other compliances of FSSAI within due time. Once the formalities are completed of registration, one can start business freely and without any legal complications.

What is FSSAI License?

Permission taken by the government for the manufacturing, selling, processing, distribution, and sale of the food products in the market is known as FSSAI License. After the registration or licensing, a 14-digit number has been provided. It will be printed on all the food packages. This number will provide all the details of the assembling state and producer’s permit. The FSSAI provides for securing a food license as one of the most essential measures for inaugurating a food industry. After receiving a food/FSSAI license, a business can be inaugurated unobstructed and without any legitimate complexity.

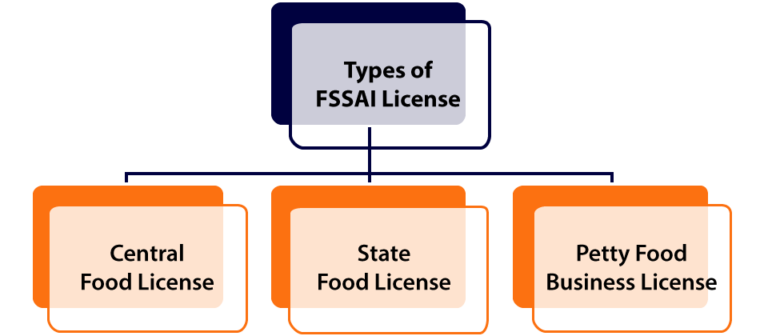

Types of FSSAI License

Types of FSSAI Registration are based on the turnover and capacity of production of the Food Business Operators. Basically, there are three kinds of FSSAI Registration which are given below-

- Central Food License

Food Business Owners, whose business is manufacturing, processing, distribution, and selling of food products outside the limit of one state or we can say that food business owners, whose business is in more than one state, need Central Food License to run such business. Central Food License must be renewed after its expiry period because it is not a one-time license. It can be canceled or suspended at any time if any activity against the norms of government is found. After the registration or licensing, a 14-digit number has been given which needs to be printed on all the food packages. This number will provide all the details of the producer’s permit. Central Food License is basically for large business owners.

- State Food License

Food Business Owners, whose business is manufacturing, processing, distribution, and selling of food products within the territory of a particular state, need State Food License to run such business. State Food License must be renewed every five years because it is not a one-time license. It can be canceled at any time if any activity against the norms of government is found. After the registration or licensing, a 14-digit number has been given which needs to be printed on all the food packages. This number will provide all the details of the producer’s permit. State Food License is basically for medium business owners.

- Petty Food Businesses License

Food Business Owners, whose business is manufacturing, processing, distribution, and selling food products within a particular area. They also need registration from FSSAI. Examples of Petty Food Businesses are hawkers, vendors, small stalls on the roadsides, etc.

FSSAI Annual Return

All the License Holders declare certain facts like per day production capacity of the entity, the stock keeping unit bar code details of the entity, etc., while the process of obtaining the license is going on in the food licensing department. To validate the facts declared by the Food Business Operators (FBO) with the actual facts, the Food Safety and Standard Authority of India mandates the filling of the FSSAI Annual Return by the FBO for lapsed financial year. Hence, obtaining a Food License is not enough for FBO. It is equally essential to file FSSAI Annual Return within the prescribed time or penalties will be faced by the Food Business Operator.

Regulatory Framework

The Food Safety and Standards Authority of India is a statutory body under Food Safety and Standards Act, 2006. The Food Safety and Standards Act, 2006 is the primary law for the regulation of food products. This act also sets up the formation and enforcement of food safety standards in India. The FSSAI appoints food safety authorities at the state level. The FSSAI functions under the administrative control of the Ministry of Health and Family Welfare. The main aim of FSSAI is to-

- Lay down science-based standards for articles on food.

- To regulate the manufacture, storage, distribution, import, and sale of food.

- To facilitate the safety of food.

Who has to take FSSAI License?

Every food business operator, including hawkers, petty shopkeepers, and others, with annual revenue of up to 12 lacks is required to register with the FSSAI. To be more specific and detailed, any company or anyone who works with food ingredients in any capacity, from manufacturing to serving, must obtain the Basic FSSAI Registration. If a food business falls under any of the following categories, a Basic FSSAI Registration is required-

- Dairy products and analogs

- Fats, oils, and fat emulsions

- Fruits and vegetable products

- Cereal and its products

- Meat and its products

- Fish and its products

- Sweets and confectionery

- Sweetening agents including honey

- Salt, spices, condiments, and related products

- Beverages, [other than dairy and fruits and vegetables based]

- Other food products and ingredients

- Proprietary food

- Irradiation of food

- Fortification of staple foods i.e. vegetable oil, milk, salt, rice, and wheat flour/Maida.

The development of standards is a dynamic process based on the latest developments in food science, food consumption patterns, new food products, and additives, changes in the processing technology leading to changed specifications, advancements in food analytical methods, and identification of new risks or other regulatory options.

Types of FSSAI Annual Return

Following are the types of FSSAI Annual Return filing-

Annual Return in Form D1

Food Business Units involved in the manufacturing, importing, labeling, packing, re-labeling, and re-packing need to file FSSAI Form D1. It should be filed on or before 31st May of every fiscal year.

Annual Return in Form D2

Food Business Operators involved in the manufacturing and distribution of milk or milk products can only file Form D2, this form is not eligible for all and is filed half- yearly i.e. from 1st April to 30th September and from 1st October to 31st March of every financial year.

Exempted Entities

The FSSAI issued a notification of exemption, exempting certain entities from filing the FSSAI Annual Return, which is as follows-

Penalty for Delay in Filling FSSAI Annual Return

The delay in filling the FSSAI Annual Return by the Food Business Operator would impose a fine of Rupees 100 every day. And if the default continues, the penalty will keep on increasing. The FSSAI keeps the track records of all the necessary requirements that need to be followed up by the FBO. Some of the noncompliance offenses are as follow-

- The sale of food without the FSSAI license for which one can be punished with imprisonment and a penalty of about 5 lakh.

- The sale of substandard quality food is considered an offense under the FSSAI regulations and a penalty of 3 lakhs.

- The sale of misbranded products is punishable with a penalty of 3 lakhs.

- The production, processing, and storage of food with unhealthy means are punished with a penalty of 1 lakh.

- If the quality of food is low the person suffers because of it, he’ll be penalized for 5 lakhs.

- The production, processing, and storage of food with unethical means are punished with a penalty of 1 lakh.

- The entity which fails to rectify its mistakes will be faced with shutting down of the business and cancellation of its license.

- If a person without the permission of the food safety officer retains, removes, or tampers with any food, vehicle, package, labeling, advertising material or other thing seized, shall be punishable with six months and a fine up to two lakh rupees.

Benefits of Complying FSSAI Annual Return

There are numerous benefits of complying with FSSAI Annual Return in India; a few of them are given below-

Reputation

FSSAI-certified food products enable the public to trust the product or entity which would sustain in the market comparatively and also increases the reputation of the entity.

Increase in Brand Value

The FSSAI Products has more reputation comparability to other products in the eye of consumers thus it creates a different entity in the market as the company’s products are certified by the Government of India.

Gets Government Support

The government support is more to the entities which are complied with the FSSAI requirements than to others. It also provides funding and loans to the entities.

Quality Assurance

The FSSAI assures the quality of food products which ensures the buyers for its consumption and quality.

Boost up of Business

If a business is FSSAI registered, it will create a good client base and boost the business on a larger scale.

Legal Advantages

FSSAI Certification will enhance the chance of legal enforcement and control over the department at a certain point and will encourage the establishment of several things in a particular area.

FSSAI Logo

As the logo of FSSAI is well known in the food industry, can ensure consumer goodwill.

Essentials of FSSAI Annual Return Filing

The Food Business Operator is required to furnish the following information while filling out for FSSAI Annual Return-

- The name of the products which are imported, exported, manufactured, or handled.

- Size of can, bottle, or any other packages.

- The quantity in metric tons.

- The selling price per unit or per kg of packaging.

- The quality which is exported and imported in kg.

- The detailed list of all the countries and ports where the product was exported.

- The rate per kg or per unit of packaging.

- As specified in the FSSAI rules, the maintenance of hygiene and sanitary standards of the factory and the hygiene of workers should be done.

- The daily records of the production, raw materials, utilization, and sales should be maintained separately;

- The source and standards of the raw materials used should be of optimum quality.

- The cleaning of the machines and equipment should be done regularly

- At least once in six months, the testing of microbiological or chemical contaminants in food products should be ensured.

- No manufacturing, storing, or exposing of any food products in any premises nearby the drain, sullage, urinal, sully, or place where the waste material is stored.

- The temperature should be accurate throughout the supply chain from the place of procurement till the time it reaches the consumer’s end.

Documents Required to get FSSAI Licence

Following is the list of documents required to obtain an FSSAI Licence-

General Documents

- Passport size photo identity proof of FBO.

- Certificate of business registration or constitution.

- Proof regarding the business premises possession such as rental, utility bills, etc

- A systematic plan of food safety management

- List of food products that are manufactured or preceded by the business operator.

- Information of the bank account number.

- Supporting documents are also needed like health NOC, copy of licenses, etc.

Special Documents

- Duly completed and signed Form-B.

- Processing unit’s plan which is showing the dimension and also the area allocation.

- Authority letter of the manufacturer where a responsible person is a nominee.

- Name and list of equipment used in the business.

- List of directors with their address, contact details, and photo id.

- List of partners with their address, contact details, and photo id.

- List of proprietors with their address, contact detail, and photo id.

Special Documents for Obtaining Central License

In addition to the basic documents, there are some special documents listed for Central License-

- Whatever raw material is used, its source has to be revealed.

- To check the 100%, a ministry of commerce certificate is required.

- FSSAI issues NOC and PA Documents

- Form 9 is mandatory.

- The Ministry of tourism issued a certificate.

- Transportation and turnover regarding documents.

- A declaration form is also needed.

- Duly completed and signed form B.

- Processing unit’s plan which is showing the dimension and also the area allocation.

- Copy of the certificate which is obtained by the coop act, 1861 and Multistate coop act, 2002.

- Whichever water is used its analysis report needs to be submitted, to confirm the portability.

- Authority letter of the manufacturer where a responsible person is a nominee.

- Name and list of equipment used in the business.

- Name and list of machinery used for the business.

- List of directors with their address, contact detail, and photo id.

- List of partners with their address, contact details, and photo id.

- List of proprietors with their address, contact details, and photo id.

The Filing of FSSAI Annual Return in India

The Food Business Operator can file for FSSAI annual report as per their convenience i.e. either via online portal or by physical appearance. The process is mentioned below:

- The only merchant can opt for an online system for Quarterly annual reports.

- The Food business operator processing milk or milk products shall file half yearly return in form D-2. The food business operator shall submit it physically to the respective Central or State Licensing Authority for the period starts from 1st April to 30th September and 1st October to 31st March of every financial year in a month from the end of the period.

- Manufacturers and importers dealing in the food business have to file an annual return form D-1. They shall submit it physically to the respective Central or State Licensing Authority on or before the starting of 31st may of every year for every food class operated by him during the previous financial year.

All the food business operators shall file a separate return for every license issued under the regulations, regardless of whether the same food business operator carries more than 1 food license.

Process for Filing FSSAI Annual Return

The offline process to file the annual return is as follows:

- Download the Food Safety and Standards [licensing and registration of food businesses] and take a printout of the form D1/D2 [as required by operator business] provided in the regulations.

- Fill in the details in the form.

- After filling the details in the form, the FBOs can send the form through a registered post or email the same to the concerned food licensing authority of their respective jurisdiction.

The details filled in FSSAI returns should be corroborations with the facts declared and mentioned in the FSSAI license. If there is any dissimilarity in the details, the FBOs should make the necessary modifications to the FSSAI license.

Budget and Finances of Food Authority

The Food Authority prepares its budget for the next financial year as prescribed by the Central Government, showing the estimated receipts and expenditure of the Food Authority and forwards the same to the Central Government.

The Central Government may, after due appropriation, make to the Food Authority grants of such sums of money as the Central Government may think fit. The food Authority on the recommendation of the Central Advisory Committee shall specify a graded fee from licensed food business operators, accredited laboratories or food safety auditors to be charged by the commissioner of Food Safety.

Who are indiabuzsolution?

indiabuzsolutionis a platform that helps people in filing online legal forms. It provides a full range of accounting, Legal Compliances, Tax & Regulatory and certification, etc. It also helps in registering companies and provides professional assistance. You can get any kind of legal advice or if you won’t get your company registered then we are just one call or text away. Following are the reasons, you should choose indiabuzsolution-

- indiabuzsolution provide professional assistance, for example, Charted Accountants and Company Secretary, etc.

- Client access and track the progress of work at any time.

- We try our best to provide you the smooth client counseling.

- We provide free legal advice as well.

- We provide our service in a time-bound manner, so that money and time of the client can be saved.

How It Works?

Fill Form

Simple fill the above form to get started

Make Payment

Make online or Offline Payment for your order.

Call to discuss

Our startup expert will connect with you & prepare documents

Work Completed

Work will be completed by us and updates delivered online

Great Support Team

I was looking for a CA for my company. One of my friend suggest me for indiabuzsolution and the team is very good. I got done my GST Registration in just few days. Thank you indiabuzsolution .

nitin tyagi

CEO

Very Powerful

indiabuzsolution Team is very supporting. The price was very reasonable. I would recommend if you want to register your company in a reasonable price then go with indiabuzsolution.

ANKIT RATHI

CEO

GOOD SERVICE

indiabuzsolution Team is very supporting. The price was very reasonable. I would recommend if you want to register your company in a reasonable price then go with indiabuzsolution.